Older news items to 2015

Office closure over Christmas - New Year

We wish you all the best for Christmas and the New Year. We will close on Thursday 24 December, 2015 at noon and re-open on Monday 4 January, 2016 at 9.00 am.

Is your business thriving or just surviving?

Despite business conditions improving an NAB survey points to rising labour costs and adverse impacts of the AUD$ for wholesale, retail and transport industries.

In a recent article SV Partners detailed some strategies for businesses with the sobering note, "It is important to understand that more businesses fail during economic recovery i.e., when an economy comes out of a recessionary period, than during the recession itself."

Shadow cast over sunset clauses

New laws apply from 2 November 2015 to sunset clauses. Sunset clauses are provisions in contracts for sales off the plan that allow the contract to be terminated if the development has not been completed. Unscrupulous developers have used sunset clauses to get out of sales and re-sell properties at a higher price.

Vendors in NSW will now only be able to rescind under a sunset clause if the purchaser consents; the vendor obtains approval from the Supreme Court; or for specified reasons which have yet to be formulated.

Land & Property Information Circular No. 2015/10

Enhancing online safety for children

Commonwealth legislation called the Enhancing Online Safety for Children Act 2015 commenced in September 2015. This legislation creates a Children's e-Safety Commissioner with powers to investigate complaints about harmful content such as cyber-bullying targeting a child. The commissioner has various powers including issuing penalties.

The legislation is aimed at social media services but it is relevant to parents and anyone dealing with children. Most organisations have policies about bullying and cyber-bullying. Harmful content can be reported to the commissioner who has powers to deal with the social media service and end user.

Link to Children's e-Safety Commissioner

Have you started or are you thinking of starting any new employees?

Have you started or are you thinking of starting any new employees?

If so, have a look at the Office of State Revenue (OSR) website on the small business grant of $2,000. For larger businesses that pay payroll tax there is also a rebate scheme called the Jobs Action Plan that you might be eligible for.

You need to register soon after you start the employee. Your number of full-time employees must increase. Charities and not-for-profit organisations will generally not be eligible.

Dubbo City Council now has a tracker for development applications

A great way to monitor your applications or those of your clients. It should make the process more transparent and encourage timely objections if there are any.

Court backs sacking of "bully" Catholic Education Office manager

This was recently reported in an article by Anna Patty in the Sydney Morning Herald on 23 November 2015 (the SMH article).

In the Federal Court of Australia decision of Wroughton v Catholic Education Office Diocese of Parramatta [2015] FCA 1236 the applicant, who was a team leader in the Employment Relations Team, claimed that her termination by the Catholic Education Office was "adverse action" prohibited by the Fair Work Act 2009 (Cth) and sought reinstatement. The application was unsuccessful and it was held that her dismissal had nothing to do with the exercise by her of any "workplace right".

The judgment referred to the report of an independent investigator who found, "There was resounding evidence that [the applicant] did target [co-workers] and did behave aggressively towards them. Examples provided of humiliating others, using the silent treatment, unreasonably withholding information vital to effective work performance, isolating, taking action that makes competent employees appear incompetent in the hope they will resign are all examples of 'bullying'. [The applicant's] behaviour led to a climate of intimidation and fear of retribution in her team.

[The applicant's] conduct impacted on other teams within the organisation and impacted on workplace productivity. This long running dispute has been extremely costly for the organisation, with the disruption and ongoing gossip in the workplace a hidden but additional cost.

Nothing has been said of [the applicant's] ability to be a warm and engaging presence in the workplace, which she clearly can be. However, this attribute does not mitigate the finding of bullying. [The applicant's] conduct throughout the Investigation was inconsistent. At times [the applicant's] was constructive, candid and cooperative and at other times, as discussed, she was obstructive and showed no regard for the impact of her deliberate delays on her employer."

The investigator concluded, "the combination of [the applicant's] substantiated bullying behaviours, her demonstrable animosity towards [co-workers] (and others in the CEO workplace), the ongoing fear of her team and her complete lack of remorse equate to a breakdown of the employment relationship between [the applicant] and the CEO. Prior to any consideration being given to the return of [the applicant] to the CEO workplace, the organisation should consider the WHS implications and their duty of care towards their employees to maintain a safe workplace."

For those considering such an action, the judge also indicated that the correct respondent was the Catholic Education Office Diocese of Parramatta rather than the Trustees of the Roman Catholic Church for the Diocese of Parramatta.

The decision also noted that only proceedings under the Work Health and Safety Act 2011 (Cth) can be dealt with by the Federal Court. However, the Commonwealth Act does not apply to a Catholic Education Office. Proceedings for an offence against the Work Health and Safety Act 2011 (NSW) must be dealt with by the Local Court or the NSW Industrial Court.

Regardless of our views on same-sex marriage, who gets a partner's dead body?

Regardless of our views on same-sex marriage, who gets a partner's dead body?

In a recent article in the SMH Tracy Spicer reported a sad story of the death of a gay man in Hobart. His partner was deemed not to be the next of kin of the deceased partner. This meant that the body was not released to the partner and the deceased's estranged parents arranged the funeral.

It is not clear to me how this situation arose. Generally speaking the executor appointed by a will must arrange the funeral. Perhaps the deceased did not have a will, appointing the executor that he wanted. It is also a good idea to leave instructions with your loved ones about what you would like for your funeral.

During your life if you are unable to make decisions about your health care the NSW Guardianship Act 1987 specifies the "person responsible for another person". This is often a spouse, which is defined by the Act to include a defacto partner. It is also possible to appoint a guardian during your life. However, in NSW it would seem that a partner and carer would be the "person responsible" because they are in the categories of a defacto partner or close friend.

(All relationships should be equal by Tracey Spicer SMH 9 November 2015)

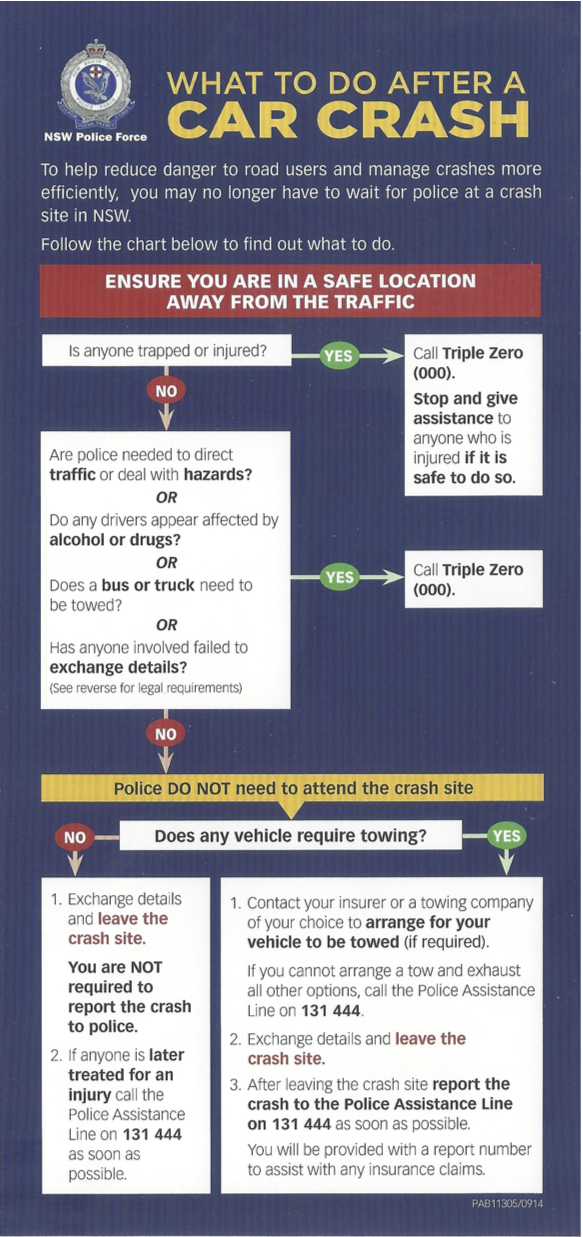

Car crash, what to do, call the police?

People often ask whether they must report an accident to the police. NSW Police have produced a handy flowchart of what to do if you are involved in a car accident. It was mailed out to households but it would be a good thing to scan and copy to your mobile phone.

Managing people, from comments I have received, is an often overlooked ability

Managing people, from comments I have received, is an often overlooked ability

A helpful guide is Workplace Conflict Guide by Nina Harding, John Whelan & Simone Farrar. It's worth a look because it is not your traditional textbook. It is an iBook with a contemporary layout and very nice artwork.

The guide is free. To view this book you must have an iPad with iBooks 2 or later and iOS 8.4 or later or a Mac with OSX 10.9 or later.

The greatest threat to your wellbeing at work is each other!

"Within five years of starting work as a lawyer, 70% of new lawyers will quit for good. In the broader workforce, 80% of Australians leave their job due to unresolved conflict, usually with someone senior, but not quit their professions. ... The Australian Productivity Commission estimates that bullying costs the economy about $14.8 billion a year and that a single episode of bullying in a workplace can cost $250,000. (Cost estimates taken from Bully Blocking at Work by Evelyn M Field, 2010). I think these figures are connected and it is clear that workplace relationships are far from safe in Australia. The greatest threat to your wellbeing at work is each other!"

(The Resilitient Lawyer - A Manual for Staying Well @ Work by Robyn Bradey 2014)

The Dark Triad - is not an action thriller but an office drama

"Personalities who deliberately inflict harm or are unable to see the harm they do to others, fall within the Dark Triad which has three component personalities: subclinical narcissism, machiavellianism and subclinical psychopathy. This constellation of personalities and behaviours correlates with bullying and other counterproductive work behaviours and workplace deviance. It has been found that psychopathy most strongly correlates with bullying, followed by machiavellianism and then narcissism."

"Personalities who deliberately inflict harm or are unable to see the harm they do to others, fall within the Dark Triad which has three component personalities: subclinical narcissism, machiavellianism and subclinical psychopathy. This constellation of personalities and behaviours correlates with bullying and other counterproductive work behaviours and workplace deviance. It has been found that psychopathy most strongly correlates with bullying, followed by machiavellianism and then narcissism."

This quotation is taken from Workplace Bullying by Joseph Catanzariti & Keryl Egan published by LexisNexis Butterworths 2015. This is a relatively short easy to read text covering both legal and psychological perspectives. Topics in the book include: The healthy self at work: How it should be; Tips for dealing with bullying personalities; Individual responses; and Resources.

Thinking about starting something in Dubbo?

Dubbo City Council can send you a newsletter about what is happening in the city and their website also has some useful resources and statistics.

Small business newsroom

We get many newletters by email. One that does seem useful is Small business newsroom from the Australian Taxation Office (ATO). You may be aware of it if you lodge Business Activity Statements (BAS). Topics in the recent newsletter included starting a small business, changing form a a sole trader to a company and buying a car for your business.

Asset protection may not work in the event of bankruptcy

Business owners and the directors of companies are often advised not to hold assets in their own names so that family assets cannot be called on in the event of a claim against the business or a director.

Keep in mind that the Bankruptcy Act (s 121) allows the trustee in bankruptcy to claw back into a bankrupt estate any transfers to defeat creditors. The transfer may have taken place many years ago, for instance, a transfer of the family home into the wife's sole name when the husband was embarking on a new business.

Generally, the bankruptcy provision will not apply to transfers for valuable consideration. It will not apply if there was not a transfer but a property purchase in another family member's name. These are all things to consider when in business and to discuss with your professional advisers.

Breach of lease by tenant & recovery of lost rent

What happens if a tenant vacates a shop before the lease is due to expire? The landlord can sue for any unpaid rent up to when the lease was supposed to end but must try to minimise the losses. What if the landlord re-lets the premises to an associate of the managing agent for a much lower rent with a three-month rent free period and still claims substantial damages for lost rent?

The NSW Civil & Administrative Tribunal (NCAT) determines isses about retail shop leases between landlords (lessors) and tenants (lessees). In a case like this the Tribunal pointed out that there is not a heavy burden on landlords to try and reduce their losses. However, a landlord still has to act reasonably, there needs to be a proper assessment of the rental market and a marketing campaign. It found in the circumstances that the landlords had not complied with their obligations and allowed them to claim only three months rent.

(Yan Gu & Chunhua Tao v Nicole Panetta, Neill Hendry Giovanni (John) Panetta [2014] NSWCATCD 247 referred to in The Law Society Lease by Dennis Bluth & Michelle Wong July 2015)

Start-up myths exposed by Caroline James SMH Businessday Mon 31 Aug 2015

"If you had a dollar for every fiction you hear when starting a business, you'd never work another day. Let's expose several things aspiring moguls are commonly told that are rarely, if ever, true.

All you need is love Business coach Ingrid Thompson has trained small business start-ups for a decade and the biggest myth is that if you think your product is the best on the planet, so will your customers. She says it is an old wives' tale that you must be wildly passionate about your service or product for your business to thrive. ''The reality is that, unless the business is offering something that others actually want and are willing to pay money for, over and over, there is no business.''

You must be in the US to sell it Simon Slade, chief executive and co-founder of SaleHoo, disagrees. ''Modern technology nearly eliminates geographic barriers and if you're targeting the US, market proximity can help,'' he said. ''But it's not essential.''

Flexible hours, more time Dani Lombard, who has been boss of her own PR agency for eight years, debunks this. ''I've found the opposite to be true – you work all the time, you really don't get annual leave,'' she said.

Must be profitable from day 1 Kusal Goonewardena says this is a furphy. ''Sometimes it takes two to three years to get your business to a profitable level and it's within the first and second year that most businesses give up, all because the owners weren't looking at the long term.''

Never mix business and pleasure Alex Tselios, founder and publisher of opinion site The Big Smoke, was given this when she started out. She has since found it to be wrong. Some of her most important business relationships are with close friends. ''Instead, the warning should be, 'Only mix business with pleasure with those who have a similar work ethic to you'.''

(See Sydney Morning Herald)

Watch out for requests by developers for proxies or powers of attorney

"Over-55s have been urged to seek independent legal advice and lodge a complaint if they are asked to sign over a power of attorney as part of a contract to enter an over-55s community title development, retirement village or manufactured home park."

Generally, strata title, community title and retirement villages legislation outlaws developers obtaining powers of attorney or proxy votes.

(See the full article Buyers Beware by Kirsty Stein in The Senior August 2015 www.thesenior.com.au)

No academy award but DVD codicil to will makes it in court

Recently a DVD recording was admitted to probate as a codicil to a written will. The court was satisfied with a formal written will and found that the DVD satisfied the requirements of an informal codicil to the will.

The court found that the deceased deliberately recorded the video refering to dispostions made freely and voluntarily. Any suspicious circumstances were adequately explained.

DVD video should not be relied on to make a will. Talk to your solicitor about your will not a film director.

(Re Estate of Wai Fun Chan, Deceased [2015] NSWSC 1107)

Small Business Grant seminars - Dubbo RSL Club Mon 17 August 2015 1:00, 5:00pm

The Office of State Revenue (OSR) is holding free seminars promoting the NSW Government's $2,000 Small Business Grant. The Grant provides up to $2,000 per new employee for businesses that do not pay payroll tax and applies to new positions filled on or after 1 July. Conditions apply.

Registration is not required for the one hour seminars and finger food is provided. Dates and locations.

Off the plan purchases - issues with valuations

Off the plan purchases - issues with valuations

It can be difficult to obtain a valuation of properties off the plan. Early pre-sales could be to friends, family members or related companies at optimistic prices. The contracts for these sales could contain a clause that allows the purchaser to rescind the contract but prospective purchasers would not know this.

Rental guarantees can also raise questions. Firstly, why would a rental guarantee be necessary if there is going to be good demand to rent the completed property? Secondly, if the promised rental in used to value the property the increased price the developer receives might be much more than the shortfall the developer could be asked to make up if it was an overestimate (that's assuming the developer is not a $2 company).

(These issues among others were raised on Nightlife with Tony Delroy on ABC Radio 28 July 2015 talking to Patrick Bright from EPS Property Search Sydney about buying off the plan)

A podcast of the interview may be available at http://www.abc.net.au/nightlife/

State of Organ - NSW Blues on bottom of donor league table

On the ABC on Wednesday The Weekly with Charlie Pickering had a segment on organ donation. For a little while the whole episode will be available on ABC iView. Its a great promotion for organ donation. The actual segment is on YouTube.

We need to register as an organ donor. In the past it could be specified on our drivers licences but now there is an Australian Organ Donor Register. Check that you are registered if you wish to donate your organs and make sure that your family knows of your wishes.

House buyers beware

House buyers beware

A legal action in the Supreme Court of NSW against two vendors failed recently despite the house being described as profoundly defective in its construction.

The initial judge found for the purchasers of the residential property in Dover Heights and awarded damages of $1,171,124. On appeal the question was whether the misleading representations were made in connection with the sale constituted conduct in trade or commerce within the meaning of the Australian Consumer Law? The Court of Appeal said that in the circumstances the answer was "no" and upheld the appeal. It found that ordinarily, a person who sells their home whether privately or through a real estate agent would not be undertaking those activities in the course of a trade or a business.

One of the vendors, Georgia Dandris, was an owner builder. Demolition and reconstruction would be required to rectify the breach of statutory warranties under the Home Building Act 1999 (NSW) but judgment against the owner builder was not going to be satisfied. Negligence by the other vendor, Patrick Williams, was not made out because he did not owe a duty of care to the purchasers.

The evidence was that the misalignment of the walls could be observed from tiling and walls that were not square. The contract for the sale of land contained an acknowledgement that the purchasers had inspected the property and accepted it in its current condition. It is not clear whether the council or certifier's inspections picked up the faults. Surely a pre-purchase builders report would have detected the problems.

Williams v Pisano [2015] NSWCA 177

In another later case, a vendor who had been an owner-builder and the local council certifying the work were successfully sued by a purchaser for a breach of statutory warranties under the Home Building Act 1989 (NSW) and negligence.

Chan v Acres [2015] NSWSC 1885

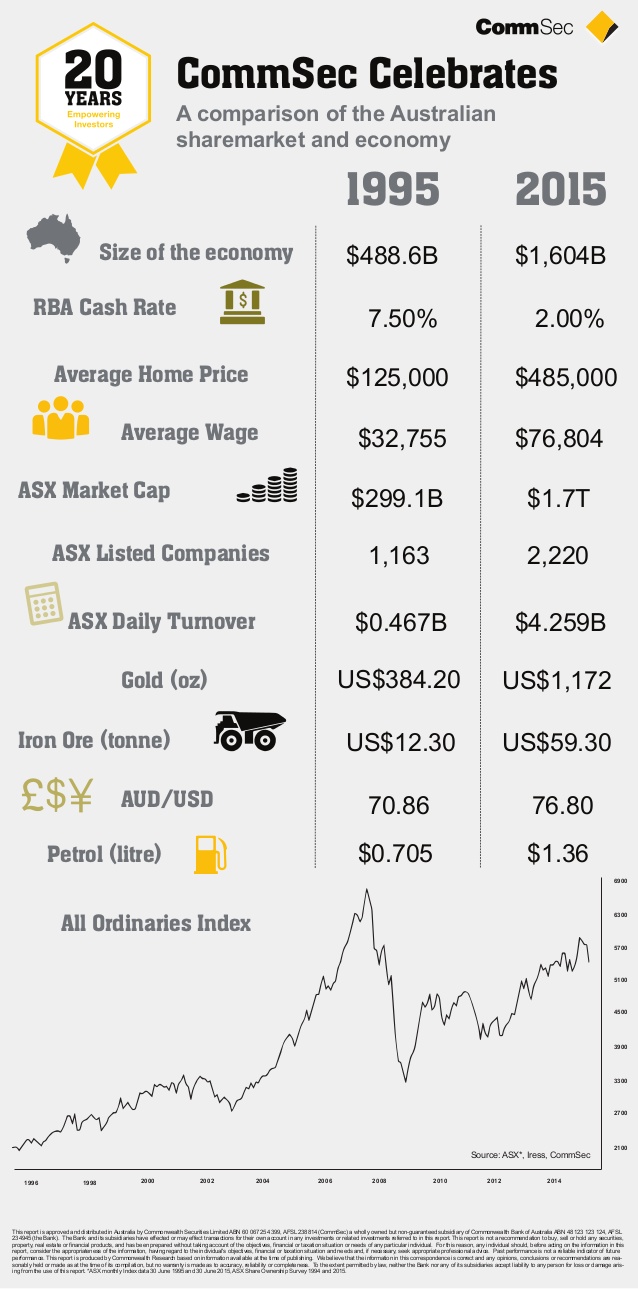

Where were we 20 years ago?

CommSec have published an interesting comparison to mark their 20th anniversary.

Published on 16 July 2015

at

http://www.slideshare.net/CommSec/commsec-20-years

Small business has 12 months to comply with SuperStream

Small business has 12 months to comply with SuperStream

From 1 July 2015 small business was required to be SuperStream compliant. Small employers (19 employees or less) now have 12 months to implement SuperStream. SuperStream requires employers to make superannuation payments and provide associated data to super funds in a specific electronic format.

For many small businesses the superannuation fund that they pay employee's super to may have already started the business using electronic lodgements. For businesses paying employee's super to different super funds a clearing house might have to be arranged.

For small employers (19 employees or less) the Small Business Superannuation Clearing House (SBSCH) is a free online service that will help small business meet their superannuation obligations. A single payment can be made that will be distributed to the various employee's super funds.

The Australian Tax Office (ATO) provides a helpful summary of what employers need to do.

Will your main residence be used partly for business?

When a business owner is buying a home it might be a good idea to purchase the property in a spouse's name for asset protection purposes. Peter Jones at PRJ Accounting Solutions also raises the following considerations:-

"Where an individual is using part of their home as a place of business, this will affect the application of the CGT main residence exemption when the home is eventually sold. That is, the main residence exemption is effectively reduced (i.e., only a partial exemption applies).

However, if that taxpayer does not have an ownership interest in the dwelling (e.g., the dwelling is solely owned by the taxpayer's spouse), the CGT main residence exemption is not reduced.

This is because the spouse would not have been able to claim a deduction for interest incurred on any borrowings to buy their interest in the house (as they do not use the dwelling for income-producing purposes, the taxpayer does).

Therefore, where a taxpayer uses (or plans to use) part of their home as a sole base of operations (or as a place of business), the dwelling could still retain the full main residence exemption when it is sold if it is owned solely in the name of the taxpayer's spouse (or even some other family member, where appropriate).

However, in these circumstances, interest expenses incurred on moneys borrowed by the spouse (or other family member) to acquire the property (or an ownership interest in it) are basically not deductible, because the spouse (or other family member) is not using the property themselves for income-earning purposes."

(From PRJ Accounting Solutions Practice Update June 2015)

Warning about the risks of buying units off the plan

"Nearly 14 years later, Engineers Australia has come up with much the same conclusions as that Herald exposé [Towers of Trouble SMH December 2001] - that new apartments are not safe, that 85 per cent of them are defective on completion and that the cost of fixing apartment buildings after completion averages another 27 per cent of the original cost. Despite a lot of political noise and reams of new legislation, nothing has really changed since 2001."

(The troubles of the towers are building by Harvey Grennan SMH Local Government section 30 June 2015)

"Tax office forces closure of pizzeria"

I saw this headline in the Short Black section of the SMH on 16 June 2015. During May 2015 the ATO lodged 556 applications to wind up small-medium company businesses. This is double the number for May 2014.

It seems that the ATO has lowered the threshold at which it takes winding up action to owing $30,000. The majority of those businesses either made no contact or effort to talk to the ATO or had defaulted on two or more repayment plans.

If directors of companies leave it until winding up applications are before the court it is too late to see help from insolvency specialists about voluntary administration or deed of company arrangement.

When you are concerned about how your business is going, get professional advice and help to address problems with the ATO.

(From Chamberlain SBR Report June 2015)

Executor fees & charges for NSW Trustee & Guardian

When looking at the executor fees and charges on the NSW Trustee & Guardian website it can be difficult to work out the fees that will be charged. On our resources page is a rough guide of how it appears that the fees are calculated. Check the fees with the NSW Trustee & Guardian, what is included or excluded in the value of the estate for the calculation and what fees and other charges have to be paid.

These fees are usually paid out of the estate before it is distributed to the beneficiaries. The best time to ask the NSW Trustee about fees and charges is when you are considering making your will with the NSW Trustee and appointing them as your executor.

How much does it cost to challenge someone's will?

How much does it cost to challenge someone's will?

An article by Barbara Drury in the Sydney Morning Herald Money section on 17 June 2015 referred to some interesting research, "According to the University of Queensland study, a review of contested cases handled by Public Trustees found the median cost to estates was $11,900, but as high as $500,000. The individuals involved incurred additional cost of up to $105,000."

The article went on to say, "The costs aren't just financial. While 18 per cent of relationships were poor before the contents of the will were known, this jumped to 26 per cent afterwards. It can take years for cases to be settled, adding to the friction between family members."

It is important to have an up to date will and to think about the needs of various family members. It is a good idea to make your will with a solicitor and discuss it with your financial planners and family.

Providing your date of birth online is a big no, no

It's a pleasant surprise when people you do not know well remember your birthday. However, we might need to rethink how they got that information.

"His one key piece of advice? Never reveal your precise age to anyone you can't trust, or publish it online. "Dates of births ... are one of the the greatest sought-after pieces of personal information that ID criminals are looking for. If criminals can get some credit card details and your date of birth it's quite easy for them to take over your identity." Filling in surveys at the check-out should also be avoided." (From Top cop says we're not prepared for Cybergeddon by Ben Grubb in Sydney Morning Herald 16 June 2015 interviewing Detective Superintendent Arthur Katsogiannis the head of the NSW Fraud & Cyber Crime Squad)

OK, so don't give your date of birth in a survey. Also, when some sites ask for your date of birth when joining up, don't fill that bit in. Unfortunately, our date of birth has most probably already been provided to Facebook, LinkedIn and in online resumés and profiles. Once that information has been out there on the web somewhere it is likely that it has been archived and may be searchable. Still, don't make it easy for fraudsters by publishing your date of birth if you can avoid it.

Happy 800th birthday for the Magna Carta on 15 June 2015

The Magna Carta is thought of as the foundation of the rule of law, that no person should be above the law. The agreement signed on 15 June 1215 at Runnymede (about 30km West of London) was first called the Charter of Liberties. The name Magna Carta came about in 1217 to distiguish it from the smaller document called the Forest Charter issued in 1217.

Copies of the Charter were made and circulated to be read out in county courts, it is believed, in Latin, French and English. There are four surviving original copies. The copy bearing the King's seal has been lost. The Charter was reissued many times and varied considerably.

"Magna Carta, as it has come to be understood and called for 800 years, operates as a shield against tyranny, abuse of power and oppression of the governed. It has become a talisman of a society in which tolerance and democracy reside."

(Nicholas Cowdrey AM QC former Director of Public Prosecutions from his article Magna Carta 800 Years Young in Law Society Journal June 2015)

"Now is the time to have a go" says Joe

Treasurer Joe Hockey said this after the Reserve Bank dropped interest rates to an historic low. Realistically however, while low interest rates may help existing business they are only one factor to consider when thinking about starting a business. You may not want low interest rates to be the main reason for starting your business.

The "have a go" sentiment was repeated with the budget, which included some accelerated depreciation concessions for expenditure under $20,000 over the next 2 years. GST paid would have been claimed as an input credit in any case so this only brings forward the depreciation that can be claimed as a tax deduction. Is this really a justification for small business spending up big?

If you are thinking of starting a business, take a look at the Business Startup Ideas on our Resources page. They provide a checklist of some factors to consider other than interest rates and depreciation deductions.

For a report on the budget see Pitcher Partners budget newsletter

Company business reminders

Company business reminders

Recently I attended a seminar by Andrew Barnden & Sam Peacocke of Rodgers Reidy Chartered Accountants about company insolvency. A couple of the practical things that came up included:-

- Make sure that the address of your registered office is up to date because this is where notices from creditors and the ATO will be sent.

- Have a system in place to deal with statutory notices or director's penalty notices when they come in, particularly, if directors will be away for extended periods of time. Strict time limits must be complied with.

- At least lodge your BAS even if a payment cannot be made and then enter into a payment arrangement with the ATO. Otherwise directors may become personally liable.

- The Personal Property Security Act (PPSA) affects businesses that sell items and businesses that place their goods in the hands of third parties. Often you must register a security interest to avoid the risk of your goods being sold by someone who takes possession of them. Goods on consignment, equipment hire and sub-contract materials might all require a security interest to be registered.

- Check your terms of trade documents with customers. Do you still hold a copy of the terms of trade signed by the customer, is it the up-to-date version and does it include a signed directors guarantee from the customer?

It could be a little bit of good news for some farmers

Under legislation following the budget, primary producers that are small business entities may be able to deduct some capital expenditure over a shorter timeframe eg fodder storage assets, water facilities and fencing assets. It appears that this will now operate from budget night, 12 May 2015.

Also, the small business measures announced in the budge may apply to farmers. Farms with a turnover of less than $2m may be able to immediately write-off asset purchases up to $20,000. This will cut out on 30 June 2017.

Also in the budget, individual taxpayers with business income from unincorporated businesses with a a turnover of less than $2m may be eligible for a 5% discount on their income tax up to a discount of $1,000.00.

In times of drought it might not be hard to come under the $2m threshold but finding the money to buy depreciating assets will be more difficult. A discount on tax is also great if you are making an income in the tough times being experienced by many farmers.

(For the precise details about this talk to your accountants)

What is the difference between a "corporate key" and "ASIC key"?

One is for company details and the other is for business names. The keys are not interchangeable. If you have a company and a business name you need both keys depending on what you want to do.

The corporate key is for companies and registered agents to update company details by logging into www.asic.gov.au/online-services (they click on the 'Log in' button underneath company officeholders or registered agents for companies).

The ASIC key is for business name holders to use their ASIC Connect account by logging into www.asicconnect.asic.gov.au (they click on the "Log in" button).

Businesses can also log into ASIC Connect with an AUSkey, which is a secure login for government online services including some Centrelink and ATO services. AUSkey requires software to be downloaded to create secure online connections. myGov is something similar but for individuals.

See ASIC InFocus May 2015 - Volume 24 Issue 4

What can you do about illegal building work?

What can you do about illegal building work?

An application for the modification of an existing development consent or for a building certificate can be made. It is not possible to get development approval after a building is erected. A building certificate does not approve the illegal building work, it only provides that the council will not take action against it for 7 years.

An application for a building certificate can be made by an owner or a purchaser. Council will require information, such as, plans, specifications, survey reports and engineer's certificates. The council will inspect the building. If council issues a building certificate it may still prosecute for a failure to obtain a consent or comply with a consent.

(See Councils and illegal building work by Dr Steven Berveling in Commercial Law Quarterly Dec 2014 - Feb 2015)

SMSF limited-recourse borrowing - how is it affected by divorce?

The assets in a SMSF are usually a significant part of a family's assets. As limited-recourse loans to SMSFs are becoming more popular they raise difficult issues if the couple (members of the SMSF) divorce. In any case, there is always the difficulty of comparing the values of superannuation and non-super assets.

Legislation allows for superannuation to be split, however, limited recourse loans may have to be repaid to allow that to happen. An asset in the super fund could be sold. One party may be able to make a contribution to the SMSF to pay out the other spouse but this is not always possible. This is an area of property settlements that financial advice will be essential.

(This topic was raised by SV Partners in their newsletter 23 April 2015)

Reporting to the Federal Workplace Gender Equality Agency

This applies to employers (including their subsidiaries) with 100+ employees. Reporting to the Workplace Gender Equality Agency commenced on 1 April 2015 for 2014-2015. The agency has produced a guide to assist with this but the reporting process still appears complex.

One of the purposes of the agency is to promote gender equality in the workplace. It will be interesting to see the effect on male dominated industries as well as traditionally female dominated industries. I am not sure about its application to church based employers.

If it appears to be too good to be true it is too good to be true

These are the warning words of liquidators who have seen an increasing number of insolvencies following online scams. They warn that these scams are becoming increasingly sophisticated and catching out good business people (including accountants) for amounts ranging from $100,000 to $2.5m.

See SBR Chamberlain's Report March 2015

See also the Australian Tax Office Stay Smart Online website (www.staysmartonline.gov.au) and Facebook page.

ANZAC Day - Lest we forget

As ANZAC Day approaches we remember those affected by war.

In the eight months of the 1915 Gallipoli campaign, 120,000 men died including 8,709 Australians, 2,701 New Zealanders and 80,000 Turkish soldiers. Of course, many others were wounded.

From the Law Society of NSW Journal April 2015, which at p. 32 displayed an Honour Roll of NSW solicitors involved in the First World War.

"They shall grow not old, as we that are left grow old; Age shall not weary them, nor the years condemn. At the going down of the sun and in the morning We will remember them."

Who are you dealing with? How do you look up a business name or ABN?

Since 2012 there has been a national business name registration service in Australia, which is administered by the Australian Securities & Investments Commission (ASIC). A person or company may be prosecuted if they do not register their business name unless its their own name. To register a business name a person or company needs an Australian Business Number (ABN).

It is possible to search for a business name or the owners of a business name and ABN by using the Australian Business Register's ABN Lookup.

Previously, some States also collected trading names that may not have been registered business names. Trading names are displayed in ABN Lookup but cannot be updated and will cease to be displayed after November 2018.

(See Australian Government Australian Business Register frequently asked questions.)

Fair Work, look out if you are in HR

The Fair Work Ombudsman can prosecute directors and also others "knowingly concerned" in a contravention. Apparently the Fair Work Ombudsman has a policy to hold individuals accountable, so it is likely that in the future there will be more proceedings involving named individuals as well as the directors.

Also keep in mind that turning a blind eye to conduct or "wilful blindness" (shutting your eyes and ears for fear of learning the facts) will still constitute "knowledge" of a contravention.

(See Turning a Blind Eye to Employment Law Breaches: Directors and HR Managers Beware by Joydeep Hor & Therese MacDermott in Law Society Journal Apr 2015 p. 82)

Is it all your fault at work?

Is it all your fault at work?

I would like to recommend a book It's All Your Fault At Work (Managing Narcissists and Other High-Conflict People) by Bill Eddy & L Georgi DiStefano Unhooked Books 2015. I have just finished reading it and I am still digesting it.

I am not qualified to assess the theory but the examples given are familiar personalities and situations. The writers are not encouraging unqualified diagnoses and stress the importance of not judging others. They suggest changing our own approach to high conflict people (rather than trying to change them).

It's a relatively short book and easy to read. There are a few acronyms but what I find useful is that it provides some practical strategies that could be used with anyone. The book includes chapters on workplace bullying and organizational challenges.

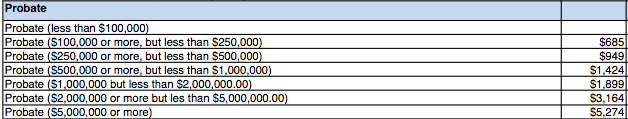

Application for probate of a will, how much do you think it costs to file with the court?

Following is a list of filing fees. The fee payable depends on the total value of the assests of the estate. These fees apply to the Supreme Court of NSW and they increase every year or so.

With the increase in the value of the family home the gross value of many estates these days is $1m to $2m. This makes higher filing fees payable. These filing fees are on top of the costs for the legal work to gather information about the estate and put together the court documents for the application for probate.

I try to encourage clients to downsize and simplify their estate as they get older. This way they may benefit family members while they are still around to explain what they are doing. Another good reason is to reduce the filing fees and legal costs that will be involved in the administration of their estates.

From Schedule 1 of the Civil Procedure Regulation 2012 as amended

How often do you check a suppliers ABN and GST registration? What if the ABN in a tax invoice is incorrect because the supplier is no longer registered for GST?

To be a creditable acquisition to claim a GST input credit, the supply to the recipient must be a taxable supply. The ATO appears to take the view that if the supplier is not registered or required to be registered then the supply will not be a taxable supply even if the recipient acts in good faith and exercises reasonable care. Where the supplier is required to be registered for GST but is not registered the supply to the recipient could be a taxable supply. A recipient can verify if a person or entity is registered for GST by searching ABN Lookup in the Australian Business Register. However, this only shows entities that are registered and not entities required to be registered.

Can you rely on the tax invoice you receive from a supplier? The ATO expects recipients to exercise reasonable care in deciding whether a supply is a taxable supply. What amounts to reasonable care? Factors include whether the supplier is a public company or major supplier, the size of the input credit claimed, if there is a regular trading relationship, if there are issues on the face of the tax invoice or if the recipient has suspicions the supplier is not registered. As a result the onus may be on the recipient to check the Australian Business Register to ensure the supplier is registered for GST.

Tax practitioner issue register - Issue 19 General

When making payments to businesses that do not quote an ABN don't forget withholding tax

Remember that you will need to withhold tax from the payments to a business that does not quote an ABN and report the amount withheld to the Australian Tax Office (ATO). See the ATO information.

Pool fencing changes postponed until 29 April 2016

From 29 April 2015 a contract for sale of land was to have attached to it a swimming pool certificate of compliance or relevant occupation certificate and evidence of registration. The introduction of this has now been postponed to 29 April 2016 (it had previously been postponed from the proposed commencement date in 2014). The reason is that there is a limited number of council inspectors available and it can take some weeks for local councils to inspect a pool and issue the necessary certificate of compliance. Also, it seems that 95% of pools are non-compliant at first inspection by council.

(Sydney Morning Herald 26 Feb 2015 & Law Society Monday Briefs 1 December 2014)

It's time to prepare for the 2014 SMSF annual return (SAR)

If assets are held by a SMSF under limited recourse borrowing arrangements (LRBAs), the ATO advises to make sure you report them at the LRBA labels in Section H: Assets and liabilities of the SAR.

If residential land worth $300,000 is held on trust under an LRBA, and the initial amount borrowed to acquire the asset under the arrangement was $250,000, the SMSF would report $300,000 at J1 Australian residential real property. If $150,000 of the amount borrowed remained outstanding, $150,000 is reported at V Borrowings.

The ATO provides some tips to help you get it right.

Working with children checks are not always tax deductible

Working with children checks are expensive but did you realise that the cost is not always tax deductible. The Australian Taxation Office provides information about deductability.

Starting a company business? ASIC offers some useful tips

This month's ASIC InFocus newsletter has some great tips on starting a business with a company. The following diagrams are particularly helpful:-

From ASIC InFocus February 2015 - Vol 24 issue 1

Lost superannuation in Australia exceeds $12 billion

The Australian Taxation Office (ATO) recently released this frightening statistic about lost and ATO-held super. Go here for a detailed breakup by State and post code.

The ATO encourages people with multiple superannuation accounts to consolidate them to save annual fees. It also recommends creating a myGov account and linking the ATO.

It is also possible to do a quick search for ATO-held super.

ATO media release on 2 February 2015 & Tax Institute Tax Vine 6 Feb 2015

NSW Valuer-General's release of valuations - 2015 land tax thresholds

With the release of land value revaluations by the VG's Department it is timely to remember that tax is payable on the land value of property. This can be an issue if you own two or more properties or if a property is used for something other than your residence. Until a house is built on vacant land its value can be added to the value of other property you own to calculate land tax.

Talk to your accountant about land tax. You may have to register with the NSW Office of State Revenue (OSR) details of the property you own. The OSR can be contacted on telephone 1300 858 300 and their website is www.osr.nsw.gov.au.

The land tax threshold for 2015 is $432,000. A marginal tax rate of 1.6% of the aggregate taxable value above the tax-free threshold (plus $100) applies unless the taxpayer is trustee of a special trust. The premium rate threshold increases to $2,641,000. If the aggregate taxable value exceeds the premium rate threshold, a marginal tax rate of 2% applies.

Thinking of selling your house with a pool in the new year?

From 29 April 2015 a contract for sale of land must have attached to it a swimming pool certificate of compliance or relevant occupation certificate and evidence of registration. Keep in mind that it can take some weeks for local councils to inspect a pool and issue the necessary certificate of compliance. Also, it seems that 95% of pools are non-compliant at first inspection by council (Law Society Monday Briefs 1 December 2014).

Office closure over Christmas - New Year

We wish you all the best for Christmas and the New Year. We will close on Wednesday 24 December, 2014 at noon and re-open on Monday 5 January, 2015 at 9.00 am.

Major changes to the home building laws

Some major changes to the home building laws in NSW start from 15 January 2015. For a summary of the changes see Fair Trading.

A couple of changes to note: the Home Warranty Insurance Scheme will now be called the Home Building Compensation Fund and owner-builders will not be able to get statutory insurance. If a property is sold by an owner-builder within the 6-year warranty period the contract for sale must state that there is no statutory insurance on the property.

Online shopping, buying & selling at Christmas time & any time

Christmas is a busy time for shopping and online shopping is becoming more popular. However, caution needs to be exercised when dealing with sites that do not have a shopfront.

For some tips about online safety have a look at the Federal government's site Stay Smart Online.

Bankruptcy wills & self managed super funds (SMSF)

If a bankrupt receives an inheritance it will be shared between the bankrupt's creditors. A bankrupt's parents should change their wills so that a gift does not go to the bankrupt or is left in a testamentary trust for the bankrupt's children.

A bankrupt cannot be a trustee of a self managed super fund (SMSF). If a bankrupt has a SMSF they need to act promptly to make sure the super fund remains compliant.

Mediation resources & cultural issues

Following a presentation given recently a heads of agreement pro forma and a list of topics for consideration has been added to our mediation resources. Also a few thoughts about the cultural aspects of negotiation and ADR.

Buying a car? Consumer & tenancy issues.

Buying a car is something that you do not usually need a solicitor to help with but there are still a number of legal issues to consider. The NSW Department of Fair Trading has a great Car buyers guide. The Fair Trading website also has other information for consumers, business, landlords & tenants and community organisations.

Did you have a win on the Melbourne Cup? If so, can the ex claim part of it?

Not wishing to dampen the euphoria of those few who won with a bet on the Melbourne Cup, it brings to mind a recent decision of the Family Court in Eufrosin v Eufrosin [2014 FamCAFC 191. The husband lost his appeal for more of the family property because of his ex-wife's $6m lotto win. However, this was a decision on the facts of the case and the result will not be the same in every situation.

While on family law, is the ex able to touch the property brought by a trust? Most probably. See the informative article by Kirstie Colls of Barry Nilsson Lawyers.

Do you know any of these 400 charities?

If the Australian Charities and Not-for-profits Commission (ACNC) does not hear from 400 particular charities by 24th November 2014 their registration will be revoked by the ACNC and they will lose their tax concession status. It might be that some of these charities may have ceased to exist or no longer qualify as charities. It could be worthwhile to scan through the list in case there are any charities on the list that you recognise and let the members know.

For more information & the list of charities see the ACNC site and also a video about filing an annual information statement.

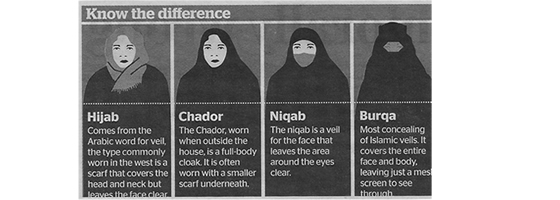

How we dress, where's the problem?

Earlier this month Islamic dress was perceived to be a problem by some in Federal parliament. The NSW Oaths Act 1900 requires an ID certificate to be completed at the bottom of statutory declarations, which requires the face of declarants to be seen. However, Islamic dress in practice rarely seems to present a problem.

As a matter of respect and courtesy below is a copy of a graphic that appered in the Sydney Morning Herald on 2 October 2014 showing the correct expressions for different styles of clothing.

Perhaps the SMH art department could also publish a graphic to avoid confusion about the following styles of clothing: budgie smuggler, muffin top, bogan and hoodie.

For some overseas travellers and those requiring notarial services see our resources page.

Starting or selling a business? Business names information from ASIC

ASIC has produced a booklet about business names and a link to it has been included on our Resources page.

There has been some concern that if a seller of a business applies to transfer the business name but the sale falls through that the business name will be cancelled. Page 9 of the booklet sets out a procedure to request the transfer of business name to be stopped.

School entitled to 90% indemnity from teacher

A teacher in breach of contract and employment conditions was ordered to indemnify the employer for damages paid to a student. In this case there was serious misconduct that was concealed. Nearly all the fault was attributable to the teacher. The teacher was ordered to pay $472,500 to the employer.

See JK v State of New South Wales [2014] NSWSC 1084 and article by Emma Chapman of McInnes Wilson Lawyers (Qld) for Legalwise Seminars

New promotional video - "Thanks Dan!"

Last Friday I attended a seminar at which the presenter showed a few videos. Following is a link to an unbelievable video advertisement by a lawyer. The lawyer is in Pittsburgh PA USA and the video must surely be a spoof. It's definitely not the sort of thing for downtown Dubbo NSW Australia.

"Thanks Dan!" YouTube video advertisement

Published on Mar 5, 2014 @ThanksDanEsq Debut Criminal Defense Commercial from Pittsburgh's Criminal Defense Rookie of the Year. I am ready to take on any case for any client. I do not stop fighting and I do not stop being creative. I am crazy like a fox. ******CONTACT ME****** Phone: (412)454-5582 Email: Daniel.Buckley.Muessig@gmail.com Office: 210 Grant St. 4th Floor Pittsburgh, PA 15219

Right to Know Week 2014

Today is the official start of Right to Know Week (as opposed to know your rights week) in NSW. Visit the Information & Privacy Commission for information about your rights to access government information.

On the other hand for some plain language information about legal rights you could take a look at the Foolkit site.

What's best for kids

Legal Aid NSW has a great site for some family law information for parents and children at www.bestforkids.org.au

What about the subcontractor when the head contractor goes bust?

Earlier this year information was circulated about recent changes to the Building & Construction Industry Security of Payment Act 1999 (NSW).

Subcontractors should also keep in mind that the Contractors Debts Act 1997 (NSW) which allows an unpaid sub-contractor or supplier to apply to a court for a debt certificate after obtaining judgment or filing an adjudication certificate in the court. The contractor can then serve that debt certificate with a notice of claim on the principal who engaged the defaulting contractor.

The judgment can be a default judgment where the defaulting contractor did not attend court. An adjudication certificate is one issued under the Building & Construction Industry Security of Payment Act 1999 (NSW) procedure.

The Contractors Debts Act 1997 (NSW) applies to residential building work while the Building & Construction Industry Security of Payment Act 1999 (NSW) has more restricted application.

Claiming expenses on rental properties for tax purposes

The ATO advises:-

"Claiming rental property expenses?

We are increasing our focus on rental property deductions, so it's important your clients get their claims right.

Some common errors made by rental property owners include:

- claiming rental deductions for properties not genuinely available for rent

- incorrectly claiming deductions for properties only available for rent part of the year such as a holiday home

- incorrectly claiming structural improvement costs as repairs when they are capital works deductions, such as re-modelling a bathroom or building a pergola

- overstating deduction claims for the interest on loans taken out to purchase, renovate or maintain a rental property.

We have released a series of short videos which explain the tax implications of buying, owning and selling a rental property. Share these with your clients to help them get their claims right this tax time."

To access the videos, go here

From Tax Institute Tax Vine No. 30 dated 22 August 2014

Business law - Thinking about opening or buying a restaurant? It's not a picnic in the food industry?

There was some food for thought in an article in the Sydney Morning Herald on 12 August 2014. In his article, "The Chain Gang" for the Good Food section of the Sydney Morning Herald, Michael Harden writes, "Tight restraurant profit margins in Australia's hospitality industry is a well-worn lament, but it can be tough for a single owner-operator to get a foot in the door, let alone make a living."

A hospitality management consultant, Tony Eldred, was quoted as saying, "there has been something of a perfect storm in the past 15 years that has seen average profit margin expectations plummet from about 18 per cent to closer to 5 or 6 per cent. The number of hospitality businesses in Australia has increased by 400 per cent since 1990 [24 years], with the industry being driven by property developers who put cafes and restaurants into every building now rather than doing a proper feasibility study about whether there's a true market for it. During this period, the population's only increased by 20 per cent ..."

For some timeI have observed that it is tough for clients in cafés, restaurants and the food industry generally. Business purchasers need to consider the lease commitments and overheads and budget for them. They will also need to monitor their trading with the help of business advisers. With tight margins there is not much room for movement in the event of unexpected expenses, business disruptions or ill-health.

High conflict personalities in legal disputes

A counsellor that I work with in mediations from time to time recently referred me to High conflict people in legal disputes by Bill Eddy HCI Press 2005. Bill Eddy has a background in the mental health profession, law and mediation in the US. Here are a few quotes from the book:-

"...undiagnosed and untreated personality disorders are driving much of today's litigation ..."

"High-conflict personalities stand out. Their emotions are often exaggerated. Their behaviour is repeatedly inappropriate. Minor problems become major disputes. They persist long after others let go. There is an urgency and drama to their daily lives. And they always have someone to blame."

"Those with personality disorders have it backwards. When problems arise in their lives, they cannot see their own part in the problem and therefore cannot solve the problem."

"Not everyone with a personality disorder becomes a high-conflict personality (HCP). Only those who are also persuasive blamers seem to become HCP's."

"High-conflict personalities are in court because they are difficult not because they have legitimate disputes."

Bill Eddy writes, "You do not need to diagnose a personality disorder or traits to see a pattern of dysfunctional behaviour." He warns that we must be careful not to become "enablers" and inadvertently make things worse.

Family law - relationship breakdwon - company property

The ATO has issued a ruling TR 2014/5 about the taxation treatment of payments of money or transfers of property by a private company as a result of a family law property settlement. It appears that the ATO treatment has changed. If a family law property settlement involves family companies it is important to get legal and accounting advice about deemed profit distributions under Division 7A Tax Act 1936.

See Tax Bulletin by Gavin Favelle of Pitcher Partners 8 August 2014

School law - workers compensation - bullying & harassment in workplace

For a recent unreported determination in the Workers Compensation Commission the Diocese of Bathurst admitted liability in a claim for injury as a result of the bullying & harassment of a primary school teacher in Dubbo NSW.

The Bathurst Diocese was required to pay compensation, treatment expenses and re-credit sick leave. In addition, it has had to pay interest and double legal costs with a 30% uplift. The workers compensation claim was made in February 2012 but it took until 16 July 2014 for the claim to be resolved with the admission of liability.

As is often the case the orders will not be published because they were made by consent. For insurance companies this avoids the decision being used as a precedent. As a result reported decisions may not reflect the number of successful claims. This also makes it difficult to ascertain how prevalent these types of injuries are in the workplace.

The time taken to resolve this particular matter (more than 2 years), even when liability was admitted, highlights the need for workers to identify and raise at an early stage workplace health & safety issues. Workers must record events, document medical treatment and will need the support of others.

Employers have a duty to protect the health & safety of workers. Injuries may be psychological as well as physical. Employers must be proactive. As soon as health and safety issues arise in their workplace or they are injured workers should seek medical, counselling & legal advice.

On our Resources page there are links to some useful resources in this area.

Tax time - be wary of scams

After the end of the financial year it is now tax return time. Many tax returns will be lodged online. So it is a good time to be aware of the Australian Tax Office Stay Smart Online website (www.staysmartonline.gov.au) and Facebook page. The site has some useful information about protecting yourself and your business online as well as a scam alert service.

Self managed super fund (SMSF) borrowing & limited recourse lending

Lending to self managed superannuation funds has been very popular in recent times.

I have added to our Resources page a draft of a diagram describing SMSF borrowing and limited recourse lending. The example in the draft is for the purchase of a property for $500,000 with half of the money coming from funds in the SMSF and the other half from borrowings.

This diagram could be a bit generalised. Different names could be given to some of the components and different lenders will have different requirements. A myriad of symbols and arrows may not actually clarify the situation. At least, a diagram shows how the parties, SMSF and bare (sometimes called security, property or custody) trust are separate and yet interact.

This is an area of law that seems to be in a constant state of flux. The diagram is not intended to be definitive or a substitute for legal and accounting advice.

NSW State Budget 2014 - Stamp duty & new home grant

In the NSW State Budget 2014 it was announced that stamp duty on the transfer of business assets and mortgage duty will be abolished from 1 July 2016. It might be best to wait and see if this eventuates as the abolition of these duties has been postponed a few times now.

The budget also made changes to the new home grant scheme. After 1 July 2014 only one grant can be made to an applicant per financial year. The grant will only be available to Australian citizens, Australian residents or an Australian owned body. The cap for eligible transactions is now $750,000. From a practical point of view, this will mean that applicants will need to provide copies of their birth certificate or citizenship certificate when lodging an application.

SMSF property investment is not without risks

In recent years there has be an increase in SMSF investment in residential property. Borrowing by SMSF's was introduced in 2007 but lenders have been promoting these loans because of the higher returns.

Unfortunately, Kate Jones in Buying a nest with your nest egg can be a risky strategy (Sydney Morning Herald 18 June 2014) says that with the popularity there has been a rise in scams.

Real estate scams have been around for a long time. We need to be alert to them. In addition, SMSF investment strategies requires professional advice from trusted financial, accounting and legal advisers.

Continued concern about the human & economic costs of bullying in the workplace

The internet is awash with information about bullying & harassment. There is information for both employers and employees.

Safe Work Australia has now published the draft model code of practice for workplace bullying as a guide called Dealing with workplace bullying - a worker's guide. Safe Work Australia has also published a guide for employers called Preventing & responding to workplace bullying.

The Fair Work Commission has also published a summary guide called Guide - Anti-bullying. For matters before the Commission they have published a more detailed guide called Benchbook - Anti-bullying.

Links to these guides have been added to our resources page.

Will from out Walgett way

The Supreme Court recently handed down an interesting decision in a case where grandsons challenged their grandfather's will. The grandfather had left his estate, which included a grazing property at Walgett, to his daughter. The daughter's two sons contested the will. A single expert appointed by the court concluded that it would not be economically viable to divide the property up.

The courts have generally taken the view that grandparents have no responsibility to provide for grandchildren in their wills. The court in this case made it clear that it is not exercising notions of fairness or equity, correcting hurt feelings or a sense of wrong. It has only to consider whether adequate provision has been made for the proper maintenance, education and advancement in life of the applicant. Adequate provision does not mean generous provision rather no more than is necessary.

A settlement was reached with one grandson. The other grandson obtained a modest order on the basis that a wise and just testator would have made a limited provision for his grandson. One of the grandsons had a disability. The judge commented that the basis of plaintiff's claim "seems to have been a highly developed and unhealthy sense of entitlement."

Wilcox v Wilcox No. 2 [2014] NSWSC 88 & Wilcox v Wilcox [2012] NSWSC 275.

The Fair Work Commission jurisdiction in relation to bullying complaints

The anti-bullying sections of the Fair Work Act, which commenced this year, do not apply to all employers but they can apply to bullying behaviour that occurred before the commencement of the legislation.

The recent McInnes v Peninsula Support Services Inc [2014] FWC 1395 & [2014] FWCFB 1440 was a decision by the Fair Work Commission in two parts. It was decided that Peninsula Support Services, which was a government funded charity incorporated under Victorian legislation, was not a constitutionally-covered business as required by the Commonwealth's Fair Work Act 2009

This part of the decision comes as no great surprise because the definitions of a constitutionally-covered business in the Fair Work Act do not cover State governments or unincorporated bodies (for example, sole traders, partnerships, not-for-profit associations and volunteer associations) or corporations not engaged in significant business activities.

The other part of the decision related to the grounds of the application for an order to prevent the applicant from being bullied. The application relied on allegations of bullying over a six-year period from 2007 to 2013. The Full Bench of the Fair Work Commission held that the past bullying conduct could provide the basis for an order to stop future bullying conduct. However as set out above, Peninsula Support Services was not a trading corporation so an order could not be made.

In NSW a victim of bullying may have rights under the Workplace Health and Safety Act 2011. Bullying may indicate a breach of health and safety duties, the duty to consult with workers and amount to discriminatory, coercive or misleading conduct. This can leave an employer open to criminal and civil proceedings under the NSW legislation. The failure of the employer to act in good faith with mutual trust and confidence and follow its own policies may also amount to a breach of the employment contract.

Building industry security of payment

Changes to the Building and Construction Industry Security of Payments Act 1999 start on 21 April 2014. The changes include a maximum time for progress payments, a statement by the head contractor that all subcontractors have been paid and there will no longer be a need to write on a payment claim that it is being made under the Act.

See NSW Government ProcurePoint factsheets

Workplace Health & Safety, Representatives & Committees

Employers are becoming aware of their obligations which commenced in 2012 to consult about workplace safety. Two documents from Safe Work Australia have been added to our resources page. The Worker Representation and Participation Guide and the Consultation Co-operation and Co-ordination - Model Code of Practice.

The Worker Representation and Participation Guide (2012) is a good one to make available to workers either in hard copy or by .pdf attached to an email. The Guide uses acronyms throughout. PCBU (person who conducts a business or undertaking), HSR (Health and Safety Representative) and HSC (Health and Safety Committee).

The law requires employers (or PCBU's) to consult. They need not have HSR's or HSC's unless they are requested by the workers. However, the guide and model code of practice recommend them as a good way for an employer to meet its obligations to consult.

A workplace needs to identify work groups which then elect a HSR and may also form a HSC. Item 4 in the Guide lists the extensive powers of HSR's. They can issue provisional improvement notices. Item 5.2 is about HSR training which is not compulsory. In Dubbo the WCAE runs a 5 day course for HSR's. Item 6.1 is about HSC's.

The Consultation Co-operation and Co-ordination - Model Code of Practice is a locked Word document. There is also a .pdf version available but the Word version is a smaller file size.

Item 3.1 of the Code is very interesting about the sharing of information by the employer. Item 4.2 spells out the need for consultation. Item 4.3 sets out what is to happen if a worker asks for a HSR. Five or more workers can ask for a HSC (item 4.4). Appendix A is a checklist for employers.

The relevant legislation is the Work Health and Safety Act 2011 Part 5 sections 46-49 and 75-82. Section 76(2) is about the nomination of members of a HSC. Work Health and Safety Regulation 2011 Chapter 2 is about representation and participation and Chapter 3 is about general risk and workplace management.

Swimming Pools

Swimming pool owners have been required to register their pools on a NSW State government online register since 29 April 2013. From 29 April 2014 a contract for sale of property with a swimming pool was to include a certificate of compliance before it could be sold or leased. The commencement of this requirment has now been postponed to 29 April 2015.

Personal Property Securities Register (PPSR)

The two-year transitional period came to an end on 30 January 2014. Security interests in personal property that existed before 30 January 2012 were given temporary protection during the transitional period. This temporary protection no longer applies and transitional security interests that were not migrated to the PPSR must now be registered.

See PPSR factsheet

Charities

The Australian Charities & Not-for-profit Commission (ACNC) has been operating since 3 December 2012. Registration with the ACNC is voluntary but from 1 January 2014 the ACNC was to determine charitable status for Commonwealth purposes by a new definition. Prior to the last Federal election the Coalition policy was to repeal this definition. So there remains some uncertainty in this area.

See "Charities & tax" Taxation in Australia Vol 48(4) October 2013 p 180

Retirement villages

The new standard contract, general inquiry document and disclosure statement for NSW retirement villages must be used for contracts entered into on or after 1 October 2013.

From Law Society of NSW Monday Briefs 23 September 2013

New forms for powers of attorney

From 13 September 2013 a new form for an enduring power of attorney and a separate form for a general power of attorney have been prescribed. The new forms can be used now but the new enduring power of attorney form is compulsory from 1 March 2014.

From Law Society of NSW Monday Briefs 16 September 2013

Will Awareness 2013

While legal practitioners are aware of the perils of home-made wills, many people think making a will is a simple exercise, and something they can do themselves. However, as people's affairs are often more complex than they realise, opting for an apparently "cost-effective" do-it-yourself will can result in delay, uncertainty and substantial legal costs to the will-maker's family and estate. This will be the focus of 2013 Will Awareness.

From Law Society of NSW Monday Briefs 5 August 2013

State taxes - 2013 State Budget

The First Home Owner Grant (New Homes) grant of $15,000 is extended for a further two years from 31 December 2013 to 31 December 2015. It will reduce to $10,000 from 1 January 2016. The abolition of transfer duty on non-land assets and mortgages has been deferred to a date to be proclaimed.

From Law Society of NSW Monday Briefs 24 June 2013

Further deferral of abolition of duties

The NSW Government has announced the further deferral of the abolition of the duty on transactions involving shares and units, business assets such as goodwill and intellectual property; and duty on mortgages over NSW property where the borrower is not a natural person. The reason given was the need to fund the Gonski education reforms. The government has not indicated when these duties will now be abolished.

From Pitcher Partners Stamp Duty Bulletin 29 May 2013

Reminder: 2012 State Budget - Office of State Revenue (OSR)

Further information on the following changes to state taxes and grants as part of the 2012 State Budget can be found on the OSR website

- New Home Grant Scheme

From 1 July 2012, a new $5,000 grant will be provided to buyers of new homes, whether off the plan or newly built, with a value up to $650,000 and to buyers of vacant land that is intended to be the site of a new home valued up to $450,000. The grant is targeted at all non-first home buyers and is available to investors as well as owner occupiers. The grant will be administered through the transfer duty payment process. The relevant form and factsheet will be made available prior to the commencement of the grant. - First Home – New Home

From 1 July 2012 the transfer duty exemption cap on new homes increases to $550,000 with duty concessions for new homes valued between $550,000 and $650,000; and the cap on vacant land increases to $350,000 with duty concessions for vacant land valued between $350,000 and $450,000. - First Home Owner Grant (New Home) Scheme

From 1 October 2012, the First Home Owner Grant Scheme will be replaced by the First Home Owner Grant (New Home) Scheme. The new scheme will only apply to first home owners who purchase or build a new home valued at up to $650,000. The grant will increase from $7,000 to $15,000 from 1 October 2012 to 31 December 2013 and to $10,000 from 1 January 2014. - Deferred abolition of duties

The abolition of marketable securities duty on unquoted marketable securities has been deferred until 1 July 2013. The abolition of duty on mortgages has been deferred until 1 July 2013. The abolition of transfer duty on non-land business assets has been deferred until 1 July 2013

From Law Society of NSW Monday Briefs 25 June 2012